ФГБОУ ДПО "ИПК"

ФГАОУ ВО «Государственный университет просвещения»

Москва, г. Москва и Московская область, Россия

Россия

Россия

Представлены результаты исследования вероятных тенденций влияния производственно-технологических и социально-экономических трансформаций, происходящих в XXI в. на развитие зеленой энергетики. Проанализированы две основных тенденции, характеризующие будущее развитие энергетической сферы, отражающее борьбу новых элит, владеющих собственностью на альтернативные источники энергии (зеленую энергетику), и старых элит, делающих ставку на традиционную энергетику. С позиций сценарного анализа оценены вероятные изменения общественной и частной собственности в сфере энергетических ресурсов под влиянием происходящих технологических трансформаций, с одной стороны, и геополитэкономических изменений, с другой стороны.

оценка, перспективы, развитие, зеленая энергетика, XXI век

Introduction

Under the conditions of large-scale production and technological transformations [30], which entail radical socio-economic changes, significant changes invariably occur in various areas, including energy.

The current global world economic crisis, which is of a very deep nature [38], is precisely a large-scale production and technological transformation caused by the replacement of the fifth technological order by the sixth [31], and not the COVID-19 pandemic, as it is usually justified [40,46 ].

Considering the ongoing production and technological transformations, it should be noted that the technologies included in the core of each subsequent emerging technological order, as a whole, represent a more perfect combination of the use of material, energy and intellectual resources (Fig. 1) [42].

At the same time, in the conditions of a natural decline at certain stages of the crisis, due to a change in technological patterns, the intensity of the use of material and energy resources (as indicated by the arrows pointing down (↓) in Fig. 1), ensuring the stability of the economy is traditionally restored due to the growth of an intellectual product - a cluster innovations (as indicated by the upward arrow (↑) in Fig. 1) [37].

Taking into account the patterns of change in technological patterns within the framework of large cycles of economic activity, N.D. Kondratiev [18], it should be noted that both in the period of the previous global economic crisis of a technological nature in the 1970s, caused by the change of the fourth technological order by the fifth one [39], and in the current global economic crisis, predicted by the author back in the mid-2000s [37,41], the cornerstone of the economic crisis of a technological nature of the 2020s was the crisis in the energy market [20], or rather in the global hydrocarbon market, which was confirmed by the collapse in world oil prices in the spring of 2020 [50].

Due to these circumstances, it is of particular interest to consider the expected changes in technologies in the field of energy resources, a potential option of which is the radical replacement of traditional energy with green energy (including, first of all, carbohydrate energy), which predetermined the relevance of the topic of this study.

Fig.1. Dynamics of resource use during the period of technological paradigms change [42].

Purpose of research

Thus, the purpose of the presented studies is to predict possible scenarios for the future development of the energy resources sector, implying a confrontation between traditional and new (green) energy in the context of production and technological transformations induced by the transition from technologies of the fifth to the sixth order taking place in the 2020s, and entailing socio-economic and geopolitical transformations.

Methodological base of research

The methodological base of the research was made up of scientific works devoted to the study of the prospects for the development of the energy resources sphere by such authors as Boltanova E.S. [8], Vakhnadze G. [56], Egorova A. [54], Ivanova S.A. [12], Ivanovsky B.G. [55], Kamyshansky V.P., Shekhovtsova A.S., Mantul G.A. [15], Konov F. [57], Lavrik T.M., Frolov S.A. [26], Ryazanov V.T., Osadin N.N. [27], Salieva R.N. [28], Sergeev V., Surakhanyan S. [29], Sivaev S.B. [32], Suyunchev M.M. Repetyuk S.V. Fine B.I. Tregubova E.A. [34], Sharlay A. [58], Shitsko A.V., Demchenko S.K. [52], Shnipova A. [53] and others.

The methodological basis of the research was also made up of the author's developments on the problem under consideration, which were reflected in the works [6,7,20,33,35,36,59,60-63,67,68] and others.

The main content of research

Considering the energy product, it should be noted that at present the following trends in the development of this market have developed.

The first trend is associated with the so-called "global energy transition" to alternative energy sources (Fig. 2), which can form new world elites [51]. First of all, we are talking about hydrogen energy.

Fig.2. Modern types of alternative energy.

At the same time, the main criteria for the effective development of new energy sources are a high level of safety, energy efficiency and economic efficiency of their use [42].

On the one hand, if there is sufficient political will, states are able to provide sufficiently large volumes of energy production based on new sources as public property, and hence relatively low prices for the proposed energy resources, at least within the country.

In the absence of the appropriate political will, the prices for the corresponding energy resources will not be low even in the domestic market. It is this dynamics that we have been observing in the last decades in the Russian hydrocarbon market, when, for example, regardless of the trends in world oil prices, domestic prices for gasoline and diesel fuel tend only to increase [43,44,47].

On the other hand, if the economic efficiency of alternative energy sources exceeds the economic efficiency of traditional energy sources, with a very high degree of probability, the leaders in its production and marketing will be transnational corporations, which today create more than half of the world's gross product, form more than 70% of world trade. , account for more than 80% of investment in R&D and hold four out of five registered innovation patents.

In this case, the world market will be dominated by private ownership of energy resources.

The second trend in the development of the energy market is to maintain the leading role of traditional energy with its relatively high energy and economic efficiency. In this area, there is also a trend in which entrepreneurs seek to transfer energy resources from public ownership to private ownership.

A typical example of the transfer of public ownership to private ownership to domestic ownership is the transfer of the Russian electric power system (RAO UES - Russian Joint Stock Company "UES of Russia", which existed in 1992-2008), which has always been considered a natural state monopoly, as a result of an unnatural reform into separate companies, when generating and marketing companies became private [13].

Speaking about the importance of traditional energy for the world economy, it is appropriate to recall that the global economic crisis of the 1970s was provoked precisely by problems in the hydrocarbon market [20]. Similarly, the problems of the current global economic crisis of the 2020s, although they were retouched by the problems of the COVID-19 pandemic [46], are in fact fundamentally technological in nature (due to a change in technological patterns), which manifested itself accordingly in the energy market (market traditional energy) [40].

In addition, attention should be paid to the fact that the bulk of the confrontations in the world, manifested in the form of armed conflicts (Iraq, Iran, Kuwait, Libya, Syria, etc.) are associated with the desire to redistribute property in the oil market.

Today, many economic sanctions against Russia are also related to the hydrocarbon sector: for example, sanctions against the construction of Nord Stream 2, against Lukoil in Senegal, sanctions against LNG projects implemented by Russia abroad, etc.

There are also known attempts to peacefully redistribute territories, due to ownership of hydrocarbon sources. Thus, in 1946, the United States attempted to buy the island of Greenland from Denmark for $100 million [11], but was refused by official Copenhagen. In 2019, the United States repeated this attempt, offering Denmark $600 million for the island of Greenland [14] (which, however, is half the amount offered in 1946 in comparable prices), but was also refused.

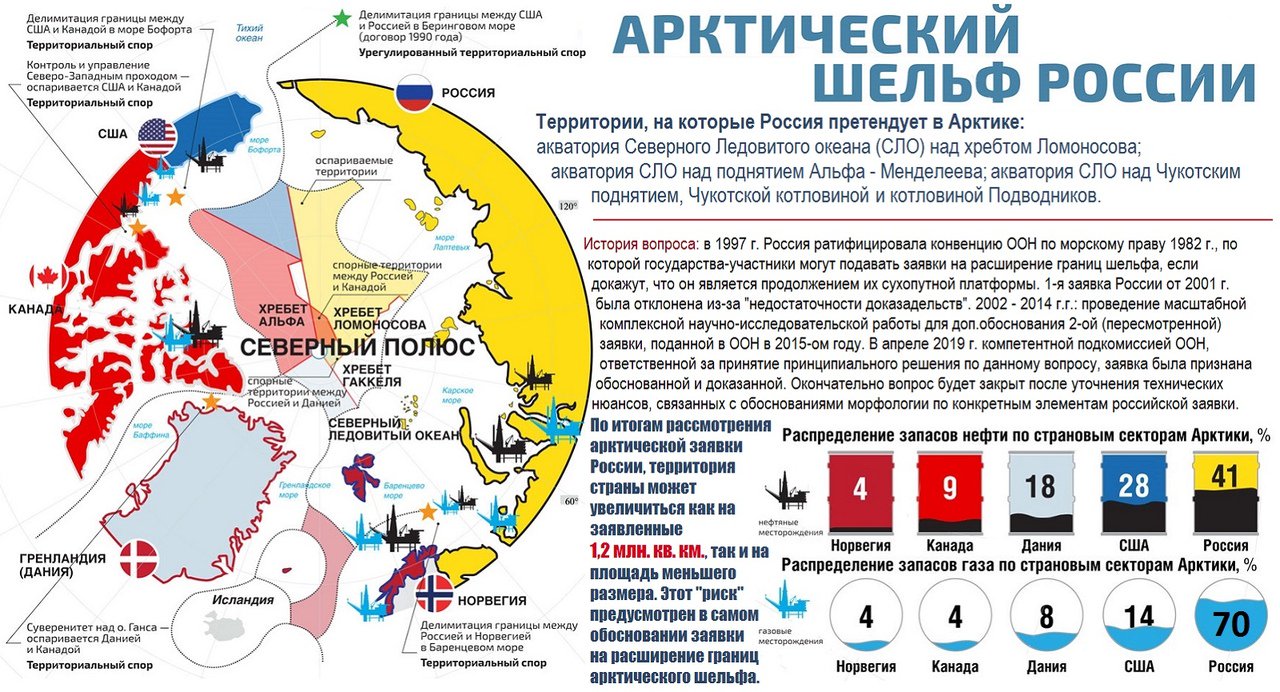

Today, emphasis should be placed on the avalanche-like growth of attention of the leading countries of the world to the Arctic [5] (the territory of which was originally distributed among five countries), where about 13% of the world's oil and about 30% of the world's gas are concentrated [10], and, and where Russia has the largest share of gas and oil reserves (Fig. 3) [49].

Fig.3. The distribution of the territory of the Arctic between the five countries under the treaty of 1920, signed on the basis of the sectoral approach [49].

If at the beginning of the 20th century the distribution of territories unsuitable for habitation and practical use in the Arctic was quite suitable for countries with access to the North Pole, within the framework of a sectoral approach (Fig. 3), then after the global economic crisis of the energy nature of the 1970s [19] , the attention of many countries of the world to the Arctic, rich in deposits of oil, gas, gas condensate, oil and gas condensate has increased many times over. This was expressed in the adoption by the UN in 1982 of the Convention on the Law of the Sea [17], the essence of which is that the jurisdiction of the state extends only to the territory of the shelf, while the off-shelf zone is proclaimed international (Fig. 4).

According to experts, any country that has signed the UN Convention on International Law of 1982 [17] will be able to prove that its continental shelf extends into the Arctic for more than 200 miles, and, therefore, can claim the resources located in this zone.

In addition, according to the clause on the International Seabed Area of the UN Convention on International Law (Table 1), “the right to explore and develop both the enterprises of the countries-participants of the Convention, and individuals and legal entities under their jurisdiction and control, for which parties to the Convention” [17]. In fact, the last phrase opens up great opportunities, first of all, for TNCs as owners of advanced technologies, large-scale production capabilities and colossal financial resources.

Among the largest players in the oil and gas sector in the Arctic, foreign companies ConocoPhillips, CNOOC, CNPC, Shell, Statoil, Total S.A. stand out. and others, as well as domestic Gazprom, Gazprom Neft, Lukoil, Novatek, Rosneft.

In general, today four groups of countries claim the Arctic territories (and primarily the hydrocarbons concentrated in them) [24]:

- firstly, this is a group of five countries with a coast on the Arctic Ocean (Denmark, Canada, Norway, Russia, USA), which, according to the 1920 treaty, signed on the basis of a sectoral approach, have priority rights to develop resources in the Arctic;

- secondly, this is a group of subarctic countries that are either in close proximity to the Arctic Circle (like Iceland), or have territories located beyond the Arctic Circle (like Finland and Sweden);

- thirdly, these are international organizations of Western countries (such as the European Union, organizations of the Nordic countries (Nordic Council, including the autonomies of the Aland Islands, Greenland, the Faroe Islands, as well as Denmark, Iceland, Norway, Finland and Sweden), NATO;

Fig.4.a. Characteristics of the main parts of maritime spaces according to the 1982 UN Convention on the Law of the Sea [17].

Fig.4.b. Characteristics of the main parts of maritime spaces according to the 1982 UN Convention on the Law of the Sea [17].

- a number of non-Arctic states claiming Arctic resources (India, China, Singapore, South Korea, Japan, etc.).

Moreover, even many non-Arctic states claiming Arctic resources have developed their own Arctic strategies [3,4,21,48].

Russia, as well as other "first hand" countries (USA [22], Canada [16], Norway [23], Denmark [1]) is also developing its strategy in the Arctic [45] (Fig. 5).

Fig.5. The Arctic zone of the Russian Federation (AZRF) [2].

It is clear that the interests of countries trying to influence the situation in the Arctic do not substantially coincide.

As a result, the contradictions between states that seek to influence events in the Arctic are constantly growing.

At the same time, among the reasons for the growing contradictions of stakeholders in the Arctic (effective transport routes, tourism, military presence, etc.), the struggle for natural resources plays a key role [9].

Of course, at present, the high technical complexity of hydrocarbon production in the Arctic, expressed in the high labor intensity of work, and, ultimately, in the high cost of oil and gas production, to a certain extent hinders the business activity of stakeholders in this region of the planet.

However, the expectation by the interested parties of the impact of global warming on the Arctic region, which simplifies the extraction of minerals, increases the contradictions of these interested parties at the interstate level, in fact, to the state of "combat readiness" for hybrid wars.

At the same time, TNCs are in many cases behind the states claiming the resources of the Arctic.

It should be noted that in the longer term, the same fate obviously awaits the Antarctic, where not only more than nine-tenths of the planet's fresh water reserves are concentrated, a large amount of graphite, gold, coal, copper ore, molybdenum, nickel, lead, zinc, etc. but also billions of tons of oil and more than a hundred trillion cubic meters of gas [25].

Obviously, if humanity were close to creating alternative energy sources that are superior to traditional energy sources in terms of efficiency / cost, then the struggle for hydrocarbon resources around the world would not grow every day, but would gradually lose its relevance.

This thesis is also substantiated by the results of a whole range of studies, which proved the inconsistency of the currently proposed ESG green economy model [62,63].

In these works, in particular, it is noted that at present, the ESG sustainable development model [64] (Fig. 6) is gaining more and more popularity in managing the development of socio-economic systems in almost any direction and scale of management [64] (Fig. 6), the number of references to which in the media doubles every year [ 65].

Fig.6. ESG Sustainability Model.

On the one hand, the ESG methodology standards (Fig. 7) [62] are designed to ensure the achievement of the goals of sustainable development of human society, developed and adopted in 2015 by the UN General Assembly as "a plan to achieve a better and more sustainable future for all" [66] (Fig. 8).

However, as studies have shown, the ESG sustainable development model [64] (Fig. 7) is not able to autonomously ensure the effective development of both national and global economies, since its mechanism is based on a significant increase in costs allocated to the development of the social superstructure of society, without any or significant tools for developing the economic basis of society.

Especially clearly the inability of the ESG sustainable development model to independently ensure the effective development of the national economy manifested itself in the current geopolitical and economic conditions of the development of society, when the world ceases to be unipolar [67].

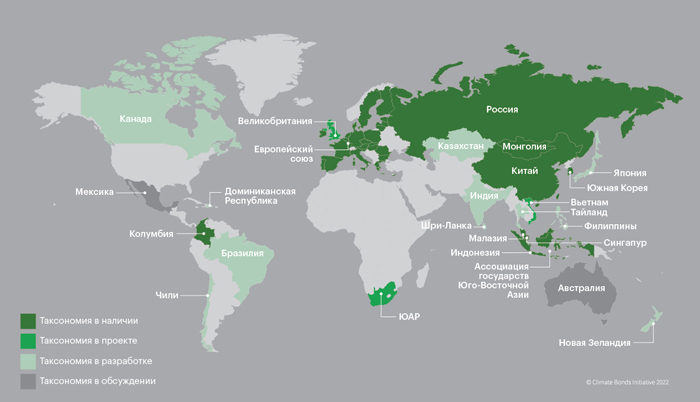

In addition, as practice shows the implementation of the ESG standards as an integral part of the “Plan to Achieve a Better and More Sustainable Future for All” [66] of the UN, which implies that all participants comply with the proposed rules of cooperative games [68], the initiators of the introduction of green taxonomy on the planet and many of them followers are in no hurry (or do not strive) to implement these plans (Fig. 9), heavily burdening the economies of other countries with compliance with the requirements of ESG standards. As a result, in fact, as shown in [62], “there is a “leaky sieve” on the planet in green taxonomy, in which it is not necessary to talk about a common (by the whole world) solution of world environmental and social problems” [62].

A summary of the reasons why the ESG model is not able to ensure the full-scale sustainable development of the Russian economy in modern conditions, identified in [62], is shown in Fig. 10.

Fig.7. ESG sustainable development methodology standards [62].

Fig.8. The 17 Sustainable Development Goals identified by the UN in 2015 in the outcome document defining the new 2030 Agenda: "Transforming Our World: The 2030 Agenda for Sustainable Development". [66]

Fig.9. World map of green taxonomies [69], demonstrating the imbalance in the level of solving the world's environmental and social problems through the ESG model.

Fig.10. A summary of the reasons why the ESG model is not able to ensure the full-scale sustainable development of the Russian economy in modern conditions, highlighted in [62].

Fig.10. A summary of the reasons why the ESG model is not able to ensure the full-scale sustainable development of the Russian economy in modern conditions, highlighted in [62].

Taking into account the problems of using the ESG model (Fig. 6) to ensure the full-scale sustainable development of the Russian economy in modern conditions, in [62] a new national model of sustainable development of economic entities - EMESG (Fig. 11) was proposed, including blocks: economic development, market development, environmental development, social development, managerial development.

Fig.11. A new national model of sustainable development of economic entities, proposed in [62].

At the same time, EMESG (Fig. 11), in contrast to the ESG model (Fig. 6), covers the development of not only the social superstructure, but also the economic basis of society [62].

The scenario analysis made it possible to assess the likely changes in public and private ownership in the energy sector under the influence of ongoing technological transformations, the results of which are shown in Fig. 12, where the scenarios are numbered in order of decreasing probabilities [59].

|

Options for possible changes in public and private property in the energy sector |

Public property

|

Private property |

|||

|

|

|||||

|

Alternative energy

|

|

|

TNK TNK

|

||

|

Traditional Energy |

State

|

|

|||

Fig.12. Scenario analysis of probable changes in public and private property in the energy sector under the influence of ongoing technological transformations.

The results of the scenario analysis made it possible to assess the likely changes in public and private property in the energy sector under the influence of ongoing technological transformations [59].

Most likely, in the coming decades, the growth of private ownership in the field of traditional energy will continue (scenario 1).

There is a rather high probability that in the foreseeable future TNCs will smoothly transfer their business from traditional to alternative energy sources (scenario 2).

But even if states are the first to develop technologies for the production of highly efficient alternative energy sources, the initiative for their practical use will most likely be seized by TNCs (scenario 3).

Discussion of results and conclusions

Thus, the conducted studies made it possible to give the following assessment of the prospects for the development of green energy in the 21st century.

Firstly, in the context of the ongoing large-scale production and technological transformations, caused by the replacement of the fifth technological order by the sixth, and not by the COVID-19 pandemic, as it is customary to justify it, radical socio-economic changes are certainly taking place in various areas, including energy.

Secondly, considering the prospects for the development of energy in the 21st century as a whole, it must be taken into account that the ongoing production and technological transformations, it should be noted that the technologies included in the core of each subsequent emerging technological order, as a whole, represent a more perfect combination of the use of material, energy and intellectual resources.

Thirdly, in the context of a natural decline at certain stages of the crisis, due to a change in technological patterns, the intensity of the use of material and energy resources is falling and ensuring the stability of the economy is traditionally restored due to the growth of an intellectual product - a cluster of innovations (including in the energy resource market).

Fourth, the patterns of change in technological patterns within the framework of large cycles of economic activity by N.D. Kondratiev show that both during the previous global economic crisis of a technological nature of the 1970s, caused by the change of the fourth technological order by the fifth, and in the current global economic crisis of the 2020s, the cornerstone of the economic crisis of a technological nature as a whole was the crisis in the energy market - in the global hydrocarbon market, which was confirmed by the collapse in world oil prices in the spring of 2020.

Fifth, the past crisis in the hydrocarbon market increases the relevance of considering the expected changes in technologies in the field of energy resources, a potential option for which is the radical replacement of traditional energy with green energy. At the same time, the main criteria for the effective development of new energy sources are a high level of safety, energy efficiency and economic efficiency of their use.

Sixth, consideration of trends in the energy resource market made it possible to identify a number of probable trends in its development, the first of which is related to the so-called “global energy transition” to alternative energy sources, which can form new world elites. First of all, we are talking about hydrogen energy.

Seventh, it should be noted that, if there is sufficient political will, states are able to provide sufficiently large volumes of energy production based on new sources as public property, and hence relatively low prices for the proposed energy resources, at least within the country. In the absence of the appropriate political will, the prices for the corresponding energy resources will not be low even in the domestic market. This is exactly the dynamics we have been observing in the last decades in the Russian hydrocarbon market, when, for example, regardless of the trends in world oil prices, domestic prices for gasoline and diesel fuel tend only to increase.

Seventh, if the economic efficiency of alternative energy sources exceeds the economic efficiency of traditional energy sources, with a very high degree of probability, the leaders in its production and marketing will be transnational corporations, which today create more than half of the world's gross product, form more than 70% of world trade. , account for more than 80% of investment in R&D and hold four out of five registered innovation patents. In this case, the world market will be dominated by private ownership of energy resources.

Eighth, there is a very high probability of maintaining the leading role of traditional energy with its relatively high energy and economic efficiency, since in this area there is also a trend in which entrepreneurs seek to transfer energy resources from public ownership to private ownership.

Ninth, when evaluating the importance of traditional energy for the world economy, it is appropriate to recall that the global economic crisis of the 1970s was provoked precisely by problems in the hydrocarbon market, and note that similarly, the problems of the current global economic crisis of the 2020s, although they were retouched by problems COVID-19 pandemics, in fact, are basically technological in nature (due to a change in technological patterns), which manifested itself accordingly in the energy market (traditional energy market). It should also be noted that the bulk of the confrontations in the world, manifested in the form of armed conflicts and sanctions pressure on countries (Venezuela, Iraq, Iran, Kuwait, Libya, Syria, Russia, etc.) are associated with the desire to redistribute property in the hydrocarbon market.

Tenth, when analyzing the prospects for the traditional energy market, one should focus on the avalanche-like growth of the attention of the leading countries of the world to the Arctic, where about 13% of the world's oil and about 30% of the world's gas are concentrated.

Eleventh, at present, the high technical complexity of hydrocarbon production in the Arctic, expressed in the high labor intensity of work, and ultimately in the high cost of oil and gas production, to a certain extent hinders the business activity of stakeholders in this region of the planet. However, the expectation by the interested parties of the impact of global warming on the Arctic region, which simplifies the extraction of minerals, increases the contradictions of these interested parties at the interstate level, in fact, to the state of "combat readiness" for hybrid wars. At the same time, TNCs are in many cases behind the states claiming the resources of the Arctic.

Twelfth, it should be noted that in the longer term, the same fate obviously awaits the Antarctic, where not only more than nine-tenths of the planet's fresh water reserves are concentrated, a large amount of graphite, gold, coal, copper ore, molybdenum, nickel, lead, zinc, etc., but also billions of tons of oil and more than a hundred trillion cubic meters of gas.

Thirteenth, it is obvious that if humanity were close to creating alternative energy sources that surpass traditional energy sources in terms of efficiency / cost ratio, then the struggle for hydrocarbon resources around the world would not grow every day, but gradually lose would be relevant.

Fourteenth, the paper shows that at present, the ESG sustainable development model is becoming increasingly popular in managing the development of socio-economic systems in almost any direction and scale of management, the number of references to which in the media doubles every year. At the same time, the ESG methodology standards are designed to ensure the achievement of the goals of sustainable development of human society, developed and adopted in 2015 by the UN General Assembly as a “plan for achieving a better and more sustainable future for all” (including through the development of “green” energy). However, as studies have shown, the ESG sustainable development model is not capable of autonomously ensuring the effective development of both national and global economies, since its mechanism is based on a significant increase in costs directed to the development of the social superstructure of society, without any significant tools developing the economic basis of society.

Fifteenth, the inability of the ESG sustainable development model to autonomously ensure the effective development of the national economy is especially evident in the current geopolitical and economic conditions of the development of society, when the world is no longer unipolar. In addition, as practice shows the implementation of the ESG standards as an integral part of the UN “Plan for a Better and More Sustainable Future for All”, which implies compliance by all participants with the proposed rules of cooperative games, the initiators of the introduction of green taxonomy on the planet and many of their followers are in no hurry (or not aspire) to the implementation of these plans, heavily loading the economies of other countries with compliance with the requirements of ESG standards. As a result, in fact, as shown in the work, “there is a “leaky sieve” on the planet in green taxonomy, in which it is not necessary to talk about a common (by the whole world) solution to world environmental and social problems.”

Sixteenth, the main reasons why the ESG model is not able to ensure the full-scale sustainable development of the Russian economy in modern conditions are identified, including:

- ESG standards ensure the management of the predominantly social superstructure of economic entities, while in the current geopolitical and economic conditions, when the anti-Russian sanctions of the West, which, however, have always been, are even more intensified, the strengthening of the economic basis of the national economy comes to the fore, which even without sanctions The West of 2022 has been in a state of stagnation over the past decades;

- compliance with the requirements of ESG standards (for example, such as the costs of the company for organizing initiative voluntary environmental events, the amount of costs for medical services at the expense of the company per employee, charity, the company's support for the volunteer movement, etc.) require economic sources to cover them. That is, the fulfillment of a number of requirements of the ESG standards may contribute to the deterioration of the already not brilliant economic situation of the population in Russia, which, in terms of gross national income per capita in nominal terms (in US dollars), as of 2021, is in 63rd place in world ($ 11,273), which is 8.3% lower than the world average ($ 12,293);

- the most costly environmental requirements of the ESG standards can significantly burden the economic basis of the national economy. According to available estimates, even with a very conservative price per ton of greenhouse gas of $10, the cost to the economy will be ₽1.5 trillion. despite the fact that, for comparison, the entire federal budget of the Russian Federation for 2022 in terms of income was planned in November 2021 in the amount of ₽25.0 trillion. That is, 6% of the federal budget of the Russian Federation would have to be paid to the EU budget;

- implementation of the ESG standards as an integral part of the UN Plan for a Better and More Sustainable Future for All requires compliance by all participants with the rules of cooperative games. However, the world green taxonomy map shows (Figure 6) that many countries do not implement green taxonomy. So among the 20 largest economies in the world (in terms of GDP in nominal terms) the USA, Japan, India, Great Britain, Brazil, Canada, Australia, Mexico, Saudi Arabia, Turkey do not have a green taxonomy. And with such a "leaky sieve" in the green taxonomy, it is not necessary to talk about solving the world's environmental and social problems;

- in the ongoing multi-purpose hybrid war against Russia, one of the goals is the long-standing desire of the United States to replace Russian energy resources in the European market, for which the United States "pumps" Europe with unsustainably produced oil and gas. And the events of 2022 made Europe forget about its "green ideals".

Seventeenth, taking into account the problems of using the ESG model to ensure the full-scale sustainable development of the Russian economy in modern conditions, a new national model of sustainable development of economic entities - EMESG was proposed in the work, including blocks: economic development, market development, environmental development, social development, management development. At the same time, the EMESG model, unlike the ESG model, covers the development of not only the social superstructure, but also the economic basis of society.

Eighteenth, the scenario analysis carried out made it possible to assess the likely changes in public and private property in the energy sector under the influence of ongoing technological transformations:

- most likely, in the coming decades, the growth of private ownership in the field of traditional energy will continue;

- there is a fairly high probability that in the foreseeable future TNCs will smoothly transfer their business from traditional to alternative energy sources;

- but even if states are the first to develop technologies for the production of highly efficient alternative energy sources, the initiative for their practical use will most likely be seized by TNCs.

1. Allayarov R.A. Denmark's strategic interests in the Arctic. Greenland is the main factor in the preservation of the Arctic status. Problems and Prospects. // Global development trends in the Arctic: a view from the Arkhangelsk region. Materials of the scientific and practical conference. Northern (Arctic) Federal University named after M.V. Lomonosov; Compiled by M.L. Marchenkov. 2018. pp. 7-11.

2. Arctic zone of the Russian Federation (AZRF). https://neftegaz.ru/tech-library/geografiya/668885-arkticheskaya-zona-rossiyskoy-federatsii-azrf-/ (date accessed: 17.08.2022).

3. Arctic strategy of India. https://www.geopolitica.ru/article/arkticheskaya-strategiya-indii (date accessed: 17.08.2022).

4. Arctic strategy of Japan. https://pro-arctic.ru/13/04/2016/press/21081 (date accessed: 17.08.2022).

5. Battle for the Arctic: why the polar regions are so attractive. https://www.rgo.ru/ru/article/bitva-za-arktiku-chem-tak-privlekatelny-zapolyarnye-territorii (date accessed: 17.08.2022).

6. Bozrov A.R., Tebekin A.V. On the efficiency of functioning of domestic corporations in the oil and gas sector. // Journal of Economic Research. 2017.Vol. 3. No. 11. pp. 34-45.

7. Bozrov A.R., Tebekin A.V. Comparative assessment of the efficiency of functioning and assessment of market prospects for the development of the largest oil and gas companies. // Transport business in Russia. 2017. No. 5. pp. 3-6.

8. Boltanova E.S. Legal regime of property complexes in the energy sector of the Russian economy. // Property relations in the Russian Federation. 2013. No. 11, pp.50-62.

9. Struggle for the Arctic: Five Most Important Directions (Politico, USA). https://inosmi.ru/politic/20200113/246584015.html (date accessed: 17.08.2021).

10. Stocks that are difficult to extract. https://www.gazeta.ru/science/2012/05/26_a_4602393.shtml (date accessed: 17.08.2022).

11. Why did the USA need Greenland during the Cold War? https://zen.yandex.ru/media/id/5d7777457cccba00ad0f257a/zachem-ssha-nujna-byla-grenlandiia-vo-vremia-holodnoi-voiny-5d7b73369c944600ae6444b4 (date accessed: 17.08.2022).

12. Ivanova S.A. Features of the legal regime of energy resources. // Eurasian Advocacy. 2018.No. 1, pp. 87-91.

13. How RAO UES was reformed. https://www.kommersant.ru/doc/1085197 (date accessed: 17.08.2022).

14. Kalmykov A. How much does Greenland cost and why does Donald Trump need it? https://www.bbc.com/russian/features-49400738 (date accessed: 17.08.2022).

15. Kamyshansky V.P. Legal regulation of energy supply: textbook. allowance / V.P. Kamyshansky, A.S. Shekhovtsova, G.A. Mantul. - Krasnodar: KubGAU, 2019 .-- 100 p.

16. Canadian policy in the Arctic: opportunities and constraints in the context of growing tensions. https://goarctic.ru/abroad/kanadskaya-politika-v-arktike-vozmozhnosti-i-ogranichiteli-v-kontekste-narastayushchey-napryazhennos/ (date accessed: 17.08.2022).

17. UN Convention on the Law of the Sea. https://www.un.org/ru/documents/decl_conv/conventions/lawsea.shtml (date accessed: 17.08.2022).

18. Kondratyev ND, Oparin DI Big cycles of the conjuncture: Reports and discussion at the Institute of Economics. - 1st ed. - M., 1928. - 287 p.

19. Konotopov M.V., Tebekin A.V. April Theses of 2009 (On the World Economic Crisis). // Innovation and investment. 2009. No. 1. pp. 2-8.

20. Konotopov M.V., Tebekin A.V. World energy security. crisis or stability? // Innovation and investment. 2007. No. 2. pp. 3-11.

21. Medvedev D.A., Polonchuk R.A., Shashok L.A. China's Arctic Policy in the First Quarter of the 21st Century / Ed. S.N. Grinyaeva. - M .: ANO TsSOiP, 2020 . - 84 p.

22. New US Arctic strategy. https://topwar.ru/181150-novaja-arkticheskaja-strategija-ssha.html (date accessed: 17.08.2022).

23. Updated Arctic strategy of Norway. https://russiancouncil.ru/blogs/svfu-experts/34118/ (date accessed: 17.08.2022).

24. Pavlikhina A. Arctic Hosts. // Neftegaz.ru. 2020, No. 5 (101), pp. 6-7. https://magazine.neftegaz.ru/upload/iblock/479/479c92ec3a761104e41e0f39ec29d3b5.pdf (date accessed: 17.08.2022).

25. The last pantry: what riches Antarctica hides. https://info.sibnet.ru/article/546595/ (date accessed: 17.08.2022).

26. Legal regulation of relations in the field of energy: a textbook for students enrolled in the direction 030900 "Jurisprudence" / TM Lavrik, SA Frolov. - Tambov: Publishing house of FGBOU VPO "TSTU", 2014. - 80 p.

27. Ryazanov V.T., Osadin N.N. Public property and its role in the formation of the market model of the Russian economy. // Problems of the modern economy, N 1/2 (17/18), 2006. pp.54-59.

28. Salieva R.N. Types of economic (business) relations in the energy sector of the economy related to the subject of legal regulation. // Oeconomia et Jus. 2017, No. 2, pp.51-58.

29. Sergeev V., Surakhanyan S. Ownership of energy resources and sovereignty. // Cosmopolis. No. 3, 2008. pp.52-63.

30. Seryakov G.N., Tebekin A.V. Assessment of the nature of differentiation and continuity of stages and phases of technological orders. // Bulletin of Tver State University. Series: Economics and Management. 2018.No. 3. pp. 8-17.

31. Seryakov G.N., Tebekin A.V. Theoretical and methodological foundations of the study of technological structures of the economy. Monograph. / - Moscow: Rusays, 2021 .-- 88 p.

32. Creation and operation of energy service companies and performance contracts in Russia. Volume 1: Energy Service and Performance Contracts: Opportunities and Problems of Their Implementation in Russia / Sivaev S.B., ed. Gritsevich I.G. - World Wildlife Fund (WWF) - M., 2011.

33. Starshinova O. V., Tebekin A. V. World experience in the innovative development of the electric power industry. Moscow, 2006.

34. Suyunchev M.M. S.V. Repetyuk Fine B.I. E.A. Tregubova Development of approaches to the formation of a common electric power market of the Eurasian Economic Union (EAEU). - M.: RANEPA. 2020.https: //em.ranepa.ru/files/docs/research/2019_1513_preprint.pdf (date accessed: 17.08.2022).

35. Tebekin A.V. Analysis of options for Russia's foreign economic strategy in the world oil market. // Journal of Economic Research. 2020.Vol. 6. No. 1. pp. 73-81.

36. Tebekin A.V. Analysis of the prospects for the implementation of the energy strategy of the Russian Federation in terms of transportation of energy resources. // Business strategies. 2019. No. 3 (59). pp. 11-21.

37. Tebekin A.V. Innovative development of the economy. Moscow Government, Moscow Department of Education, State. educational institution of higher. prof. Education "Moscow State Academician of Business Administration. Moscow, 2008.

38. Tebekin A.V. On the depth of the 2020 crisis for the global and national economies and ways out of it. // Journal of Economic Research. 2020.Vol. 6. No. 2. pp. 52-71.

39. Tebekin A.V. Development of management concepts in the 1970s. // Journal of Historical Research. 2018.Vol. 3. No. 4. pp. 33-43.

40. Tebekin A.V., Tebekin P.A., Egorova A.A. Choosing an approach to the formation of a strategy that provides a way out of the global socio-economic crisis in 2020. // Theoretical Economics. 2020. No. 5 (65). pp. 44-67.

41. Tebekin A.V., Filatov A.A. Fundamentals of organization management. - Moscow, 2005.

42. Tebekin, A. V. Innovation management: a textbook for bachelors / A. V. Tebekin. - 2nd ed., Rev. and add. - Moscow: Yurayt Publishing House, 2020 .-- 481 p. - (Bachelor. Academic course).

43. Titova Y. A cunning scheme: why gasoline in Russia does not get cheaper even with oil prices, as in the 2000s. https://www.forbes.ru/biznes/399945-hitraya-shema-pochemu-benzin-v-rossii-ne-desheveet-dazhe-pri-cenah-na-neft-kak-v-2000 (date accessed: 17.08 .2022).

44. Tikhonov S. Why gasoline prices in Russia do not depend on oil prices. https://rg.ru/2020/02/12/pochemu-ceny-na-benzin-v-rossii-ne-zavisiat-ot-kotirovok-nefti.html (date accessed: 17.08.2022).

45. Decree of the President of the Russian Federation of October 26, 2020 No. 645 "On the Strategy for the Development of the Arctic Zone of the Russian Federation and Ensuring National Security for the Period until 2035". https://www.garant.ru/products/ipo/prime/doc/74710556/ (date accessed: 17.08.2022).

46. Khanov M. Pandemic "masks" the cyclical crisis of the world economy. https://tass.ru/opinions/8294881 (date accessed: 17.08.2022).

47. Khasanov T. Blank pistols: why gasoline in Russia is not getting cheaper. Why the cost of gasoline in Russia does not depend on oil prices. https://www.gazeta.ru/business/2020/04/09/13043131.shtml (date accessed: 17.08.2022).

48. Kholkina, Y. A. Arctic strategy of the Republic of Korea / Y. A. Kholkina, A. V. Kripakova. - Text: direct // Young scientist. - 2017. - No. 7 (141). - pp. 377-379.

49. CDU TEK. https://www.cdu.ru/ (date of access: 17.08.2022).

50. Oil prices fell below zero for the first time in history. How dangerous is it for Russia and the world? https://lenta.ru/brief/2020/04/21/wti/ (date accessed: 17.08.2022).

51. Chubais warned of a change in the world's elites due to the energy revolution. https://www.rbc.ru/politics/04/08/2021/610a4e3f9a7947bb76849ce4 (date accessed: 17.08.2022).

52. Shitsko A.V., Demchenko S.K. Interaction between the public and private sector: problems and prospects. // Fundamental research. - 2017. - No. 11-2. - pp. 467-471; URL: https://fundamental-research.ru/ru/article/view?id=41969 (date accessed: 17.08.2022).

53. Shnipova A. Alternative energy: prospects for the development of the renewable energy market in Russia. https://delprof.ru/press-center/open-analytics/alternativnaya-energetika-perspektivy-razvitiya-rynka-vie-v-rossii/ (date accessed: 17.08.2022).

54. Egorova A. Stable prospects in an unstable situation. https://www.kommersant.ru/doc/5318348 (date accessed: 17.08.2022).

55. Ivanovsky B.G. PROBLEMS AND PROSPECTS OF TRANSITION TO "GREEN" ENERGY: EXPERIENCE OF DIFFERENT COUNTRIES OF THE WORLD (Review). // Economic and social problems of Russia. - 2022. - No. 1. - pp. 58-78.

56. Vakhnadze G. Seven inconvenient facts about "green" energy, which are silent in the media. https://vc.ru/future/90256-sem-neudobnyh-faktov-o-zelenoy-energetike-o-kotoryh-molchat-smi (date accessed: 17.08.2022).

57. Konov F. Wind, sun and water: prospects for "green" energy in Russia. https://plus.rbc.ru/news/5f7227f37a8aa9e8aabd24fc (date accessed: 17.08.2022).

58. SHARLAY A. "GREEN ENERGY" IS A WORLDWIDE AND MAIN SCAM OF GLOBALISTS. PEOPLE IN MINUS, MONEY IN PLUS. https://TSARGRAD.TV/ARTICLES/ZELJONAJA-JENERGETIKA-VSEMIRNAJA-I-GLAVNAJA-AFERA-GLOBALISTOV-LJUDI-V-MINUS-DENGI-V-PLJUS_332028 (date accessed: 17.08.2022).

59. Tebekin, A. V. (2022). The future of public and private property in the energy sector. Theoretical Economics, 90(6), 13. https://doi.org/10.52957/22213260_2022_6_13 (date accessed: 17.08.2022).

60. TOPICAL PROBLEMS OF THE INTERACTION OF THE THEORY AND APPLIED ECONOMICS IN THE ERA OF PERMANENT CRISIS. Kumekhov K.K., Danilochkina N.G., Levin Yu.A., Tebekin A.V., Fiapshev A.B., Kholbekov R.O., Pavlov P., Stepanov A.A., Rybin M.V., Mitropolskaya-Radionova N.V., Fedorov L.V., Khoreva A.V., Shmarova L.V., Ignatova I.O., Khamikoev V.A. Moscow, 2022.

61. Tebekin A.V. NINE SCENARIOS FOR THE STRATEGIC DEVELOPMENT OF THE NATIONAL ECONOMY. Moscow, 2016.

62. Tebekin A. V. ON THE NEED TO CREATE A NEW NATIONAL MODEL OF SUSTAINABLE DEVELOPMENT OF BUSINESS SUBJECTS. // Journal of Management Research. 2022. V. 8. No. 2. pp. 22-34.

63. Tebekin A.V., Kushch A.I., Lomakin O.E. DEVELOPMENT OF A NEW NATIONAL MODEL OF SUSTAINABLE DEVELOPMENT OF BUSINESS SUBJECTS: THE NEED TO TRANSITION FROM ESG TO EMСESG. // Transport business in Russia. 2022. No. 3. pp. 8-16.

64. Draft National Standard ESG. Expert Center for ESG-transformation "Business Russia". Moscow, 2021.

65. Mikhail Yulkin, Tony Ran, Ivan Kukhnin, Natalya Belyaeva, Anastasia Popova. ESG is for a long time: what you need to know about the main letters of the outgoing year. https://sber.pro/publication/esg-eto-nadolgo-chto-nuzhno-znat-o-glavnykh-bukvakh-ukhodiashchego-goda?ysclid=l1vn9s2bv1 (date accessed: 17.08.2022).

66. United Nations (2017) Resolution adopted by the General Assembly on 6 July 2017, Work of the Statistical Commission pertaining to the 2030 Agenda for Sustainable Development (A/RES/71/313) (date accessed: 17.08.2022).

67. Tebekin A.V. GEOPOLITEKONOMIC ASPECT OF RESEARCH OF PROGRESS TO A NEW QUALITY OF TECHNOLOGIES, ECONOMY AND SOCIETY. // Bulletin of the Tver State University. Series: Economics and Management. 2021. No. 3 (55). pp. 38-54.

68. Tebekin A.V. METHODS OF MANAGEMENT DECISION-MAKING ON THE BASIS OF OPTIMIZATION OF PERFORMANCE INDICATORS WITH THE USE OF COOPERATIVE GAMES. // Journal of Management Research. 2018. V. 4. No. 11. pp. 39-53.

69. Climate Bonds Initiative. https://www.climatebonds.net/ (date accessed: 17.08.2022).